How to Tell If Your E-Commerce Business Is Ready for a Warehouse Management System

By: Maitri Bhardwaj

Sep 2, 2025

Table of Contents

Featured Posts

- Ease Commerce Becomes India’s Official Amazon MCF Partner: Faster Fulfillment, Zero Chaos

- How the Right Customer Support Solution Boosts FCR

- What Is Returns Management for Multi-Channel Sellers

- Choosing the Right Task Management Software for Sellers

- How to Tell If Your E-Commerce Business Is Ready for a Warehouse Management System

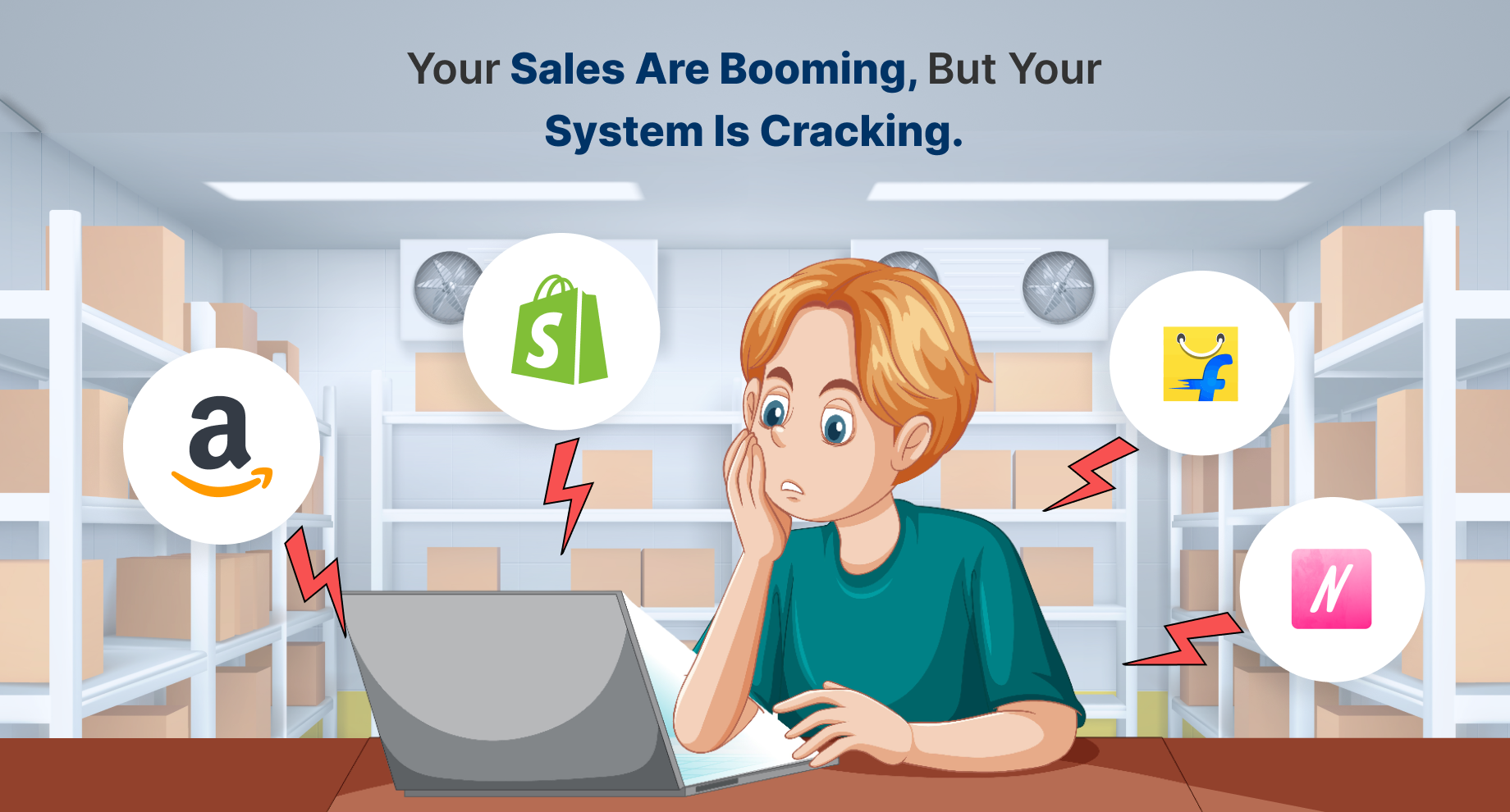

Running an e-commerce business is exciting until the backend starts cracking under growth. What worked with spreadsheets and manual updates at 50 orders a day doesn’t hold when you’re juggling thousands across Amazon, Shopify, Flipkart, and many more such online marketplaces. The real question is, how do you know when it’s time to upgrade to a Warehouse Management System(WMS)?

Let’s see how and when a good WMS comes to play.

1. You’re Selling Across Too Many Platforms to Track Manually

Here’s where most sellers hit the wall: spreadsheets and late-night reconciliations work fine when you’re managing a few dozen orders. But once sales start coming in from online marketplaces like Amazon, Shopify, Nykaa, and Flipkart at the same time, your “system” starts breaking down in ways that hurt both revenue and reputation.

Take a simple case. You’ve got 50 units of a popular red-medium SKU sitting in one warehouse. At 9 AM, every channel shows 50 units available because that’s what the last manual update pushed out. By 11 AM, Shopify has already sold 12, which should leave you with 38. The problem is that the portals such as Amazon, Nykaa, and Flipkart are still happily advertising 50. When a flash sale or lightning deal hits, Amazon alone books 45 orders because it never got the updated number. Now you’ve oversold, you’re scrambling to cancel, and your team is stuck firefighting instead of fulfilling. That’s how penalties pile up, Buy Box eligibility drops, and customer reviews start tilting negative.

The real issue isn’t poor management; rather, it’s that each channel runs on its own clock, while you’re updating stock once or twice a day. Returns, partial cancellations, and SKU mismatches only make the gaps wider. What looks like a small variance in the sheet quickly snowballs into a mess across multiple platforms.

A good Warehouse Inventory Management System flips this by becoming the single “brain” for all stock movements. The minute an order comes in, the system reserves the units, updates availability across every channel, and prevents duplicate sales before they happen. It also accounts for returns, canceled orders, or in-transit stock automatically, so your numbers stay live and reliable. For your operations team, that means no more juggling tabs or hunting down SKUs to see what’s real. For customers, it means orders that actually ship when promised.

The tipping point is simple. If you’re spending more time fixing cancellations, answering angry emails, or explaining penalties than you are scaling sales, it’s time to centralize inventory in a WMS. Growth doesn’t wait for manual updates to catch up.

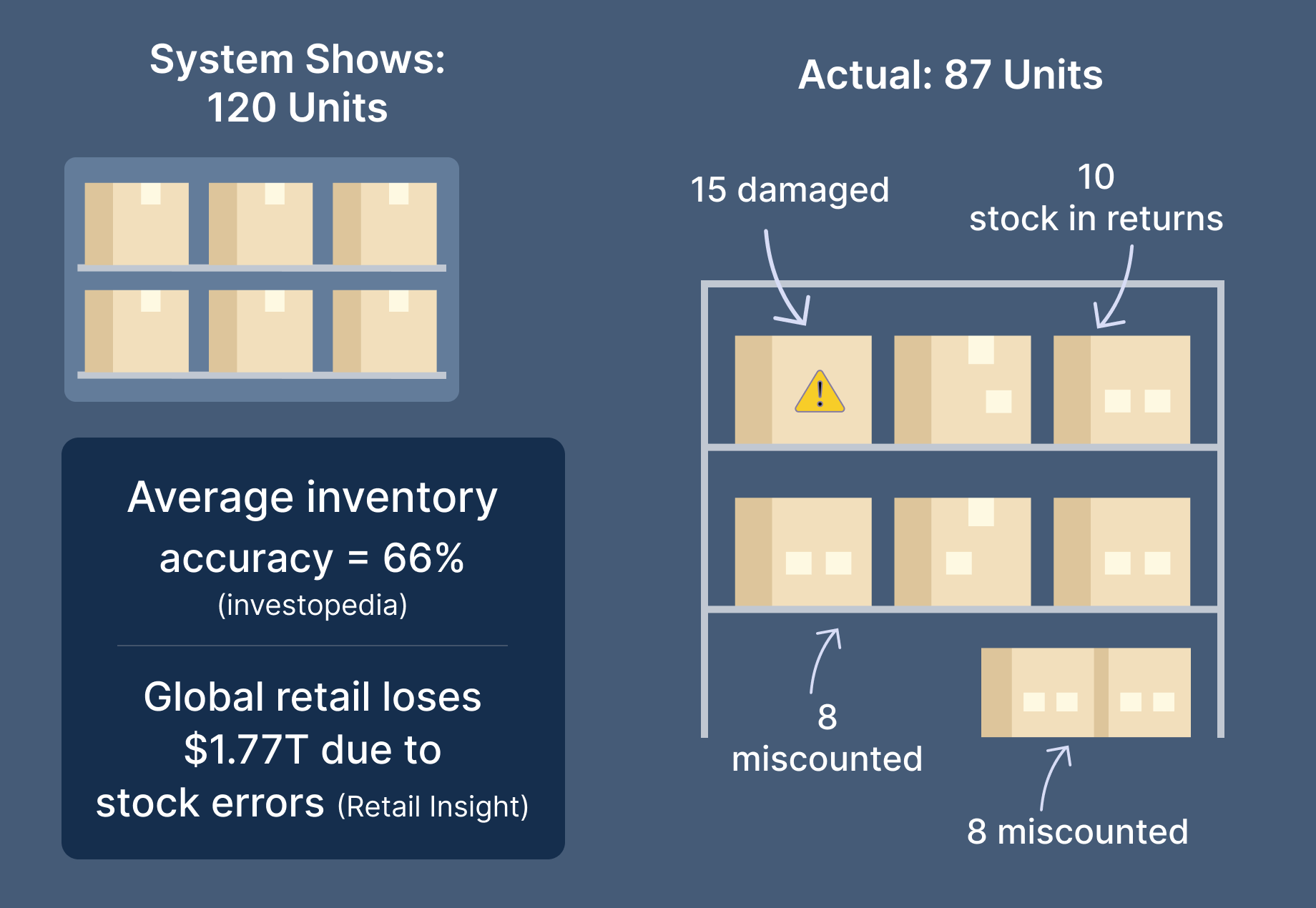

2. Inventory Accuracy Has Become Guesswork

If your team is still relying on gut feel or spreadsheets updated once a day, you’re not managing inventory; you’re gambling with it. And the numbers prove it’s a bad bet.

The average U.S. retailer’s inventory accuracy sits at just 66%, which means one in every three SKUs is recorded wrong compared to what’s actually in the warehouse floor stock . Globally, studies estimate that 60% of SKUs are inaccurately tracked, leading to overstock, stockouts, and a combined $1.77 trillion in losses across retail every year (Retail Insight). Even small deviations sting, research shows inventory errors alone can shave up to 4% off annual sales, while retailers who fixed those mismatches saw a 4–8% sales lift almost immediately (ECR Loss).

What does this actually look like? Imagine your warehouse sheet shows 120 units of a mid-range SKU. But in reality, 15 are damaged and sitting in quarantine, 10 are stuck in a courier’s return cycle, and another 8 were miscounted during the last audit. On paper, you’re flush with inventory. On the ground, you’re already short.

The mismatch shows up quietly. Your ads keep running because the system says stock is healthy. Customers click, place orders, and you start shipping. A week later, the “phantom” units never materialize, and you’re left juggling partial shipments and issuing credits. Meanwhile, those 15 quarantined units keep eating up warehouse space, blocking newer, fast-moving stock.

This is actually the capital frozen in unsellable products, marketing spend wasted on items that can’t ship, and storage costs racking up against SKUs that your system thinks are fine. And when a financial close comes around, your P&L doesn’t reflect reality. Finance has to dig through adjustments just to explain why gross margins don’t match.

A good Warehouse Management software ends the guessing game. Instead of scattered ledgers, it creates a single, live source of truth for every unit: on-hand, reserved, in-transit, and returned-to-stock. The moment a sale happens, the system deducts it across every channel. When a return clears QC, it flows back into available stock instantly. Low-stock alerts are triggered before you run out, not after customers are staring at an “out of stock” message.

The shift is dramatic. Finance no longer struggles to explain why system counts don’t match reality. Operations stop firefighting and start focusing on fulfillment speed. And most importantly, customers actually get the products they paid for, on time, every time.

3. Your Fulfillment Speed Is Holding Back Growth

E-commerce lives and dies by delivery speed. Customers don’t compare you to other sellers in your category rather they compare you to the last package they got from Amazon Prime. If your fulfillment slips, more than a minor hiccup.; it’s the reason shoppers abandon carts, skip repeat purchases, and head straight to competitors.

Nearly 69% of shoppers say they’re less likely to buy again if an order arrives late (Convey, Delivery Experience Report). And it’s not the courier who takes the blame—41% of customers hold the retailer responsible for slow deliveries, even when the package left your warehouse on time. When promises are missed, the damage doesn’t stop at refunds; it slows down the customer’s next purchase and erodes long-term loyalty.

Now, picture this in practice. A D2C skincare brand keeps stock in Bengaluru and Hyderabad. A customer in Chennai places an order, but because the system defaults to “primary warehouse,” the package ships from Bengaluru instead of Hyderabad. Delivery takes four days instead of two. Multiply that by dozens of orders a week, and suddenly your support team is buried under “Where is my order?” tickets while a competitor with smarter routing delivers faster and wins repeat business.

A Warehouse Management System changes the game by making routing decisions in real time. Instead of guessing, it automatically allocates orders to the closest warehouse that can hit the promised delivery date. It also chooses the right courier based on performance and cost for that route, not just habit. And once the order is assigned, the WMS drives efficiency on the floor too—batching picks, reducing walking time, and cutting down 55% of warehouse costs tied to picking and packing.

The payoff is simple: fewer delays, lower shipping costs, and customers who actually trust your delivery promises. When orders land in two or three days consistently, you’re not just matching expectations, you’re building the kind of reliability that keeps shoppers coming back.

At the end of the day, fulfillment speed isn’t just logistics—it’s growth. If your system keeps routing orders the long way around, you’re already losing sales you’ll never see.

4. You’re Drowning in Returns and Reverse Logistics

Returns are no longer an afterthought in e-commerce—they’re part of the customer experience. And if you’re not managing them well, they eat into margins faster than you realize.

Consider this: global e-commerce return rates hover between 18–30% depending on category, with apparel and footwear peaking even higher (National Retail Federation, 2024). That means for every 100 orders you ship, nearly a quarter might come back. Each one costs you twice—first in the lost sale, and again in shipping, handling, repackaging, and often heavy discounting if the product isn’t resellable at full price. For a growing brand, returns can quietly consume 20–25% of logistics costs.

Here’s how it shows up day to day. A customer on Amazon returns three items from a five-item order. One gets scanned into the warehouse, two are left in a “pending” pile because the SKU wasn’t logged correctly. Shopify still thinks you have those units. Meanwhile, your ads keep running for them. Weeks later, you realize you’ve been paying to store products that never got re-listed, while refund discrepancies keep piling up on the finance side.

The best warehouse inventory management systems brings structure to the chaos. Every return is tracked back to its order, with reason codes logged—was it damage, wrong item, size issue, or courier fault? The system only reintroduces items into stock once they’ve cleared QC, so phantom units don’t sneak back into your counts. Items marked “unsellable” can be routed to liquidation or vendor returns automatically. And because the WMS syncs across sales channels, available stock updates the moment items are restocked, not weeks later.

The payoff is twofold. First, customers get faster refunds and exchanges, which keeps trust intact even after a return. Second, your operations team isn’t losing hours chasing down mismatched SKUs or misplaced boxes. The system does the heavy lifting, ensuring inventory is clean, finance is accurate, and your warehouse floor doesn’t turn into a graveyard of unsorted returns.

The real growth unlock here isn’t just about reducing return costs—it’s about controlling the narrative. When returns are handled smoothly, customers are far more likely to buy from you again. In fact, research shows 92% of consumers will shop again if the return process is easy (Invesp, 2024). That means a streamlined reverse logistics process isn’t just a defensive move—it’s a loyalty strategy.

5. Data Silos Prevent Decision-Making

As e-commerce businesses scale, data tends to live in silos—sales reports in one tool, warehouse numbers in another, payouts in a third, and marketing results in yet another. On paper, each team is “tracking performance.” In reality, no one sees the full picture, and decisions get made on partial truths.

The cost of this is bigger than wasted time. A recent Salesforce report found that 70% of business leaders say data silos directly reduce operational efficiency and slow down growth. And in e-commerce, that shows up fast—inventory gets reordered late because ops can’t see real sell-through across all channels, or marketing keeps pushing a SKU that’s been out of stock for weeks, burning ad spend for nothing.

Here’s a practical example. Your ops team sees strong sell-through on Flipkart and decides to stock more of a trending SKU. But the finance team, working off separate reports, notices profit margins on that SKU are razor-thin because of higher return rates. Marketing, meanwhile, has no visibility into either side and doubles ad spend to “amplify momentum.” By the time someone realizes the SKU is unprofitable, you’ve sunk capital, warehouse space, and budget into pushing the wrong product.

If your warehouse and inventory management system is really that great, it breaks those walls by centralizing operational data into one source of truth. Instead of pulling reports from five dashboards, sales, ops, and finance all look at the same ledger: what’s sold, what’s shipped, what’s returned, and what’s actually making money. Dashboards show SKU velocity, warehouse performance, payout timelines, and customer return reasons in one place—so decisions aren’t just faster, they’re grounded in reality.

The impact goes beyond smoother workflows. When leadership has integrated visibility, they can spot patterns earlier—like a fast-moving SKU that’s running low across multiple platforms, or a courier consistently underperforming in one region. That kind of insight directly protects growth, because you’re no longer reacting late but adjusting in real time or near real-time.

In fact, McKinsey research shows that companies using integrated data systems are 23 times more likely to acquire customers, 6 times more likely to retain them, and 19 times more likely to be profitable. The message is clear: fragmented data doesn’t just slow you down, it caps your ceiling.

When data silos vanish, decision-making shifts from guesswork to strategy. And in e-commerce, where every delay costs sales, that difference is the edge between scaling and stalling.

Don’t Let Growth Turn Into Chaos

Every e-commerce brand hits the same breaking points. Inventory accuracy starts slipping, fulfillment slows down, reconciliation becomes a full-time firefight, returns pile up, and data gets trapped in silos. None of these are “bad day” problems—they’re the natural growing pains of scaling. The question isn’t if they’ll hit your business, it’s when.

That’s where a Warehouse Management System stops being optional. It gives you real-time inventory visibility, smart routing for faster fulfillment, automated reconciliation to protect cash flow, structured returns management, and integrated dashboards that keep every team aligned. In short, it replaces guesswork with control.

Ease Commerce WMS is built exactly for fast-growing e-commerce brands. Our platform syncs every sales channel, manages inventory across multiple warehouses, reconciles payments automatically, and gives you a single view of operations—whether you’re selling on Amazon, Shopify, Flipkart, or any other platform or on all of them at once. Over 2,000 brands already rely on Ease Commerce to ship faster, reduce costs, and unlock growth without adding chaos.

If your team is already spending more time fixing errors than driving sales, the signal is clear: you’re ready for a WMS.

👉 Request a Demo and see how Ease Commerce can help you scale without the growing pains.