What Is Payment Reconciliation? A Practical Breakdown

By: Maitri Bhardwaj

Aug 21, 2025

Table of Contents

Featured Posts

- Ease Commerce Becomes India’s Official Amazon MCF Partner: Faster Fulfillment, Zero Chaos

- How the Right Customer Support Solution Boosts FCR

- What Is Returns Management for Multi-Channel Sellers

- Choosing the Right Task Management Software for Sellers

- How to Tell If Your E-Commerce Business Is Ready for a Warehouse Management System

Let’s call it like it is, if the money doesn’t add up, nothing else in the business matters. It’s never “just accounting noise” when your payments are mismatched, bank statements are not aligned, invoices are left without conciliation, and vendors are complaining. All of this suggests that there’s a leak in your business’s foundation.

Payment reconciliation goes beyond basic bookkeeping; it's about ensuring every transaction is accounted for, down to the last detail. It’s the daily discipline of making every transaction match up: what’s in your system, what’s actually happened in the bank, what your customers have paid, and what your vendors have billed.

Here’s what often trips teams up:

- Delayed match-ups between bank statements and bookings, especially when payouts come days (or weeks) late or in bulk, making it hard to trace back.

- Hidden discrepancies that go unnoticed: partial payments, processing fees, or manual entries that don’t match the actual amount.

- Fraud, slipping through. Without regular reconciliation, duplicate charges or unauthorized pulls stay hidden until weeks later.

- Cash flow chaos. You think there’s more liquidity than there really is, or miss money coming in, throwing off forecasts and growth plans.

Between platform payouts, transaction fees, partial payments, failed transfers, and refund delays, things get messy fast. If you’re still trying to track this manually, good luck catching every mismatch or timing issue. But with the right system in place, you can clean this up, spot problems early, and make sure your books reflect what’s really happening.

Look, more than one CFO we know spends 30% of their time just fixing reconciliation errors. And that’s time slipping away, with your margins, your priorities, and your peace of mind right behind it.

Let’s understand what is payment reconciliation in detail, including the process involved, the benefits associated, and the best practices that every businessman should follow to keep their cash inflow and outflow in check.

What Does Payment Reconciliation Really Mean?

Payment reconciliation is just making sure the money you were supposed to receive actually landed in your account and that it matches the right invoice or order.

It might sound simple, but when you’re selling across multiple channels, using different payment gateways, and handling refunds, fees, and failed transactions, it gets complicated fast.

Reconciliation is what helps you catch those issues. It lets you spot missing payments, double charges, or amounts that don’t line up. And when done regularly, it keeps your books clean, avoids cash flow surprises, and makes your business audit-ready, whether you're reviewing daily transactions or preparing for tax season.

If you’re not matching your payments routinely, you’re making moves with no visibility. And that’s a risk you can’t afford.

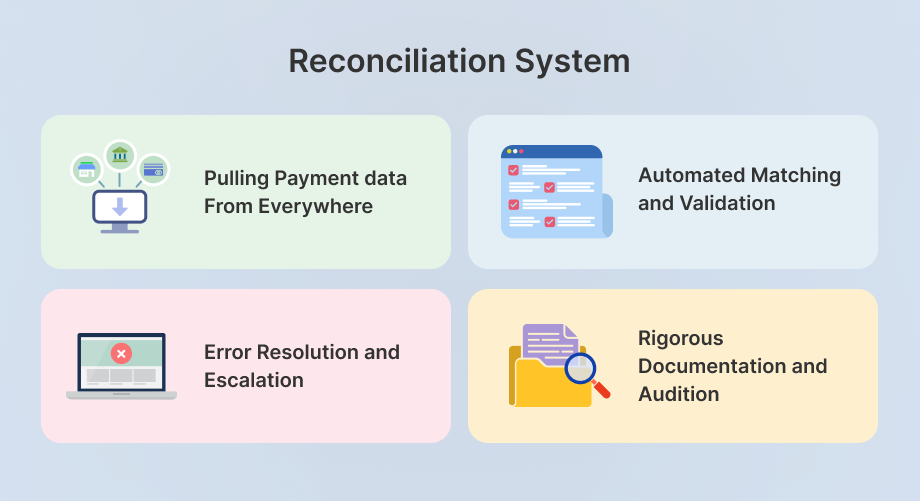

Major Components of a Payment Reconciliation System

1. Pulling Payment Data from Everywhere

Your Shopify store shows an order has been paid, but that money hasn’t landed. Meanwhile, your Flipkart store processed a return, and the gateway deducted a fee, none of which reconciles automatically in your bank feed.

You can’t fix what you can’t see. So first, centralize everything.

That means collecting transaction data from every sales and payment source you use, Amazon, Flipkart, Shopify, Razorpay, Stripe, your bank feeds, even offline POS systems if you’ve got them.

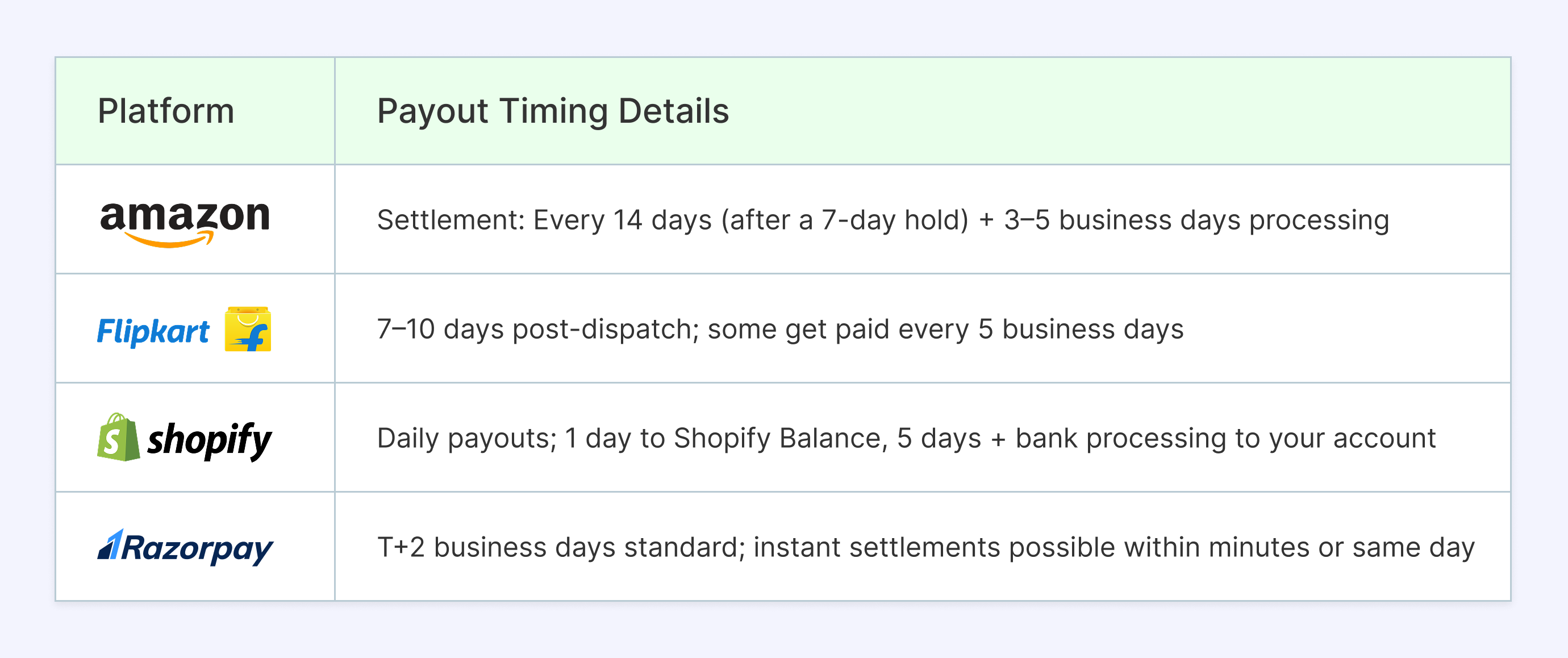

Almost all the e-commerce marketplaces settle payments at very different speeds; some send funds within 24 hours, others hold it for a week or more.

For example, Razorpay offers instant settlement, Shopify can pay out daily, Flipkart typically takes 7–10 days after dispatch, and Amazon might hold funds up to 21 days post-delivery.

Sources: Amazon Seller Payout Schedule, RazorPay Settlement Cycle, Shopify Payout Timing, Flipkart Fees & Commissions

On top of that, many brands still run trade shows, kiosks, or B2B orders paid in cash or cheque. If those don’t sync into your system, your books are incomplete from the get-go.

The more places your data lives, the higher the risk of missing key signals. A good payment reconciliation system pulls this together into one clean dashboard so you’re not chasing down CSVs from five different places or cross-checking with your accountant every week.

When all your data’s visible and current, you’ve already solved half the reconciliation puzzle.

2. Automated Matching and Validation

Once all the transactions are pulled in, the next headache is figuring out which payment belongs to which order.

You’ve got bank credits, payouts from Flipkart or Razorpay, random transaction IDs and your job is to match each one to an invoice or sale. Without automation, it’s you versus a spreadsheet, order by order. Is the date close enough? Did the fees get deducted?

Now multiply that by hundreds of orders a day. Mistakes creep in fast.

That’s where automated matching saves you. Instead of digging through sheets, good reconciliation tools auto-match based on order IDs, amounts, and timestamps, and immediately flag anything that doesn’t add up, like underpayments, duplicate charges, or missing entries.

What used to take your team 3–4 hours now takes 10 minutes with clean, confident results.

Automated Reconciliation Software takes this even further by running validations in real time, highlighting inconsistencies the moment they happen, and letting your team fix issues before they snowball into cash flow gaps or accounting errors.

It’s not just faster. It’s accurate, traceable, and way less stressful.

3. Error Resolution and Escalation

Let’s be honest. Discrepancies are a daily reality. Maybe a payment platform deducted unexpected fees. Maybe a return went through, but the refund never showed up on your end. Or a courier issued a COD and never deposited the cash.

When payments don’t line up, someone has to figure out why and fast.

In real terms, that means:

- Rechecking the marketplace commission structure to see if the cut was higher than expected

- Pulling up the original invoice and comparing it with what the bank credited

- Calling up the logistics partner to confirm if a delivery was really completed

- Or tracking down why a UPI or card payment failed halfway through the cycle

A good Payment Reconciliation System does more than highlight mismatches and gives your team a clear trail to investigate, and flags those that need escalation.

That way, you’re not stuck in email threads or Excel chaos. You resolve issues quickly, keep your records clean, and avoid small errors turning into month-end disasters.

For example:

- A payment short by ₹1,500 from Razorpay? The system tags it with a “partial match” status and pushes it to your finance lead.

- A refund marked complete on Flipkart, but no bank entry? It alerts operations to review the return window or courier logs.

- A repeated charge with the same transaction ID? It flags a possible duplicate and assigns it for an audit check.

The system solves every issue, and it makes sure nothing gets buried, and the people who need to take action are looped in instantly.

You go from:

“Let’s figure out what went wrong here” to “Here’s what’s wrong, here’s why, and here’s who needs to fix it.”

No more guesswork. No more bottlenecks. Just faster, cleaner escalation.

4. Rigorous Documentation and Auditing

You’re working with a retail distributor who claims they never received payouts for two large B2B orders processed last month.

Without documentation, you’d be sifting through emails, checking your bank manually, and trying to piece the story together.

But with a solid reconciliation system in place:

- You pull the order IDs

- Match the payment receipts

- Download the settlement logs

- Highlight the exact payout dates + references

- Share the record in minutes

The distributor gets proof. You avoid unnecessary friction. And everyone moves forward with clear data and zero doubt.

5. Scalable Technology and Integrations

As your business grows, so does the complexity with more marketplaces, more payment methods, more moving parts. If your reconciliation setup can’t keep pace, you’ll be stuck fixing broken processes instead of focusing on growth.

That’s why your system needs to connect with everything you already use Shopify, Flipkart, Razorpay, Tally, your ERP, your accounting tools. There should be no need of exporting files or merging reports manually.

Automated Reconciliation Software with built-in integrations pulls the data directly, runs checks instantly, and updates your dashboards without extra steps. It removes the silos and gives your team a single source of truth across finance and ops.

Bottom Line

Where Ease Commerce Fits In

If you're selling across multiple platforms, working with distributors, and tracking payments from different gateways, something’s always off. Either the payout doesn’t match the invoice, a return refund wasn’t logged, or a commission got deducted twice.

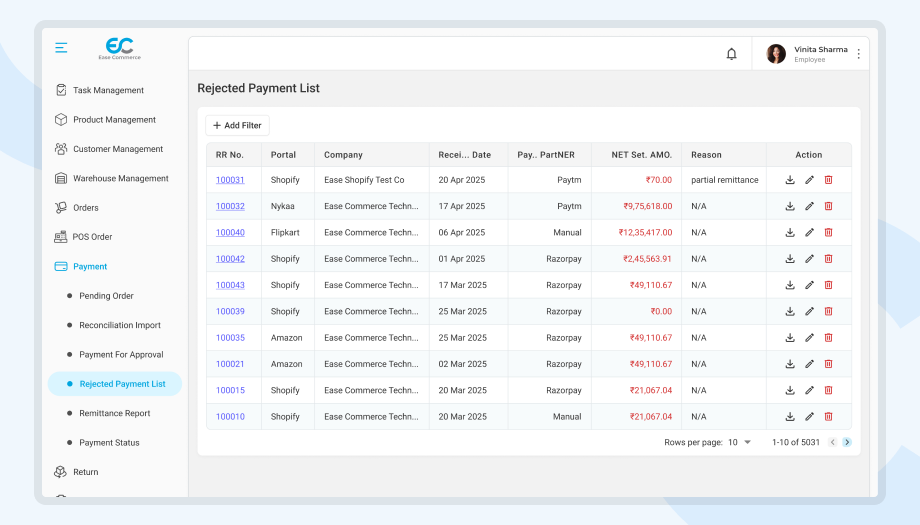

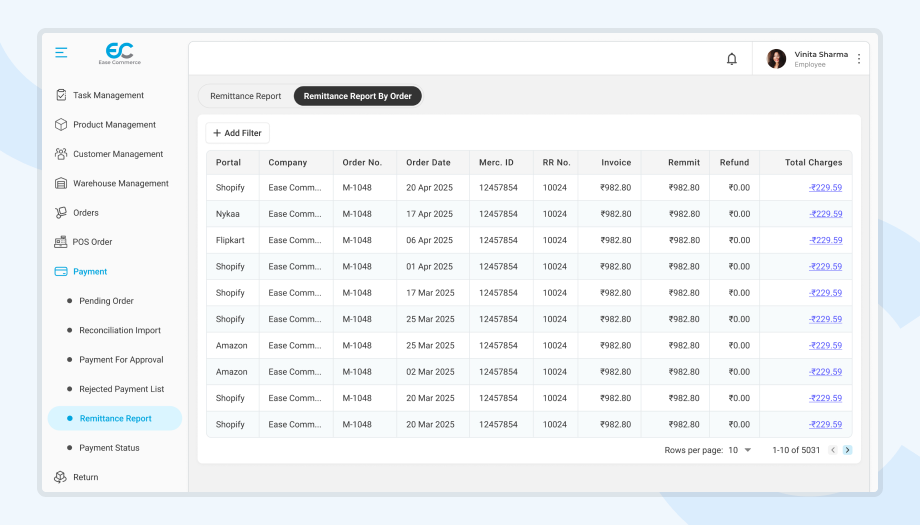

That’s where Ease Commerce steps in.

We’ve built our Payment Reconciliation software to solve exactly that. The system pulls data from marketplaces, payment partners, and your internal records; matches them, flags what’s missing or mismatched, and gives you one clean place to fix it.

In this way, the online brands and e-commerce businesses can catch errors faster and stop money from slipping through unnoticed. And their team doesn’t waste time chasing spreadsheets or decoding fee breakdowns.

Whether you’re dealing with 50 orders a day or 5,000, Ease Commerce helps you stay sharp, keep your books clean, and avoid the back-office chaos that comes with growth.

If you want fewer manual checks, cleaner reports, and full visibility into what’s actually hitting your account, this is how you get there.

Want to see how it works? Request a quick demo and we’ll walk you through it.